Financial institutions are more or less involved in people’s way of living. As the aftermath of COVID-19 crisis, the economic downturn has rendered more linkage between financial institutions and people’s lives.

With greater societal expectation to financial institutions, Fair Finance Thailand comprises 5 organizations; Sal Forest Co. Ltd., Foundation for Consumers, EnLaw Foundation, Ecological Alert and Recovery (EARTH) Foundation and International Rivers, implemented the ‘Fair Finance Standards’ according to the methodology of Fair Finance International to push forward Thai financial sector towards the notion and practice of true sustainable banking.

From 2018 until now, there were total of 4 assessments whereas 8 banks are assessed in this 4th annual policy assessment including Bangkok Bank, Kasikornbank, Krung Thai Bank, Siam Commercial Bank, Bank of Ayudhya, TMBThanachart Bank, Kiatnakin Phatra Bank and TISCO Bank, along with 3 government specialized financial institutions namely Government Savings Bank, Bank for Agriculture and Agricultural Cooperatives and Small and Medium Enterprise Development Bank of Thailand, those who have already participated since last year.

This 4th annual policy assessment applies 13 themes of the Fair Finance Guide International (FFGI) Methodology 2020 to assess publicly disclosed policies from financial institutions as of 31 October 2021.

Year of overall score improvement

The 4th annual bank policy assessment clearly reveals the overall score improvement across various themes. Average score of 11 banks rose 20.85% to 30.66 from 25.37 of the third year.

More detailed analysis shows that 8 banks’ average scores soared by 23.98% to 34.98 from the result of 28.22 in the year prior. Nonetheless, 3 of the government specialized financial institutions who have only been assessed for the second time, received the average score of 19.12 increasing by 15.77% from 16.52 in their first year.

Top 4 banks that demonstrate highest score improvement are Krung Thai Bank, Bank of Ayudhya, Kasikornbank and Siam Commercial Bank, with the result increased by 50.40%, 45.65%, 40.88% and 23.83%, respectively. Moreover, Government Savings Bank, the government specialized financial institution, raised the score by 30.68% compared to last year. This overall outcome displays striking progress for both the commercial and government specialized financial institutions.

Thai banks pay more attention to ESG Risks in 2021

Thai banks pay more attention to ESG Risks in 2021

‘ESG Risks’ or the environmental social and governance risks are the issues which gain increasing interest by the banks reflecting from the score improvement in ‘human rights’, ‘health’, and ‘climate change’. Records of these themes fell flat in previous appraisal, however, the 2021 assessment of Thai banks shows better overall direction from the score of the 3 themes.

Considering the banks’ policy in each theme compared to the year 2020, ‘human rights’ reveal the highest improvement achieving a total of 9 criteria from 5 of last year. There are 6 banks receiving score in this theme consisting Bangkok Bank, Krung Thai Bank, Siam Commercial Bank, TMBThanachart Bank, Kasikornbank and Kiatnakin Phatra Bank.

All financial institutions receive the score in human rights by committing to the United Nations Guiding Principles on Business and Human Rights while TMBThanachart Bank stands out among peers by announcing the additional human rights code of conduct aligningwith the international best practices for its customer to comply with topics such as, relocation compensation, social impact evaluation system and whistleblower process.

‘Health’ is the newly added theme in 2020 assessment and still displays low score when benchmarking with others. The result of this 4th annual assessment was fascinatingly boosted from 0.6 to 5.5 or receiving a higher score from 1 element to 8 elements. TMBThanachart Bank fulfilled this criteria for the first time this year by designating their customers’ respect on labor rights concerning health and safety at work, as described in the ILO conventions and the MNE Declaration. Bangkok Bank achieved that score in respecting international agreements on the production and the use of hazardous or toxic substances as described in the Montreal Protocol (on substances that deplete the ozone layer) while Krungthai Bank and Kasikornbank also scored in encouraging customers’ respect on international agreements on the production and the use of hazardous or toxic substances as described in the Stockholm Convention (on Persistent Organic Pollutants: POPs).

‘Health’ is the newly added theme in 2020 assessment and still displays low score when benchmarking with others. The result of this 4th annual assessment was fascinatingly boosted from 0.6 to 5.5 or receiving a higher score from 1 element to 8 elements. TMBThanachart Bank fulfilled this criteria for the first time this year by designating their customers’ respect on labor rights concerning health and safety at work, as described in the ILO conventions and the MNE Declaration. Bangkok Bank achieved that score in respecting international agreements on the production and the use of hazardous or toxic substances as described in the Montreal Protocol (on substances that deplete the ozone layer) while Krungthai Bank and Kasikornbank also scored in encouraging customers’ respect on international agreements on the production and the use of hazardous or toxic substances as described in the Stockholm Convention (on Persistent Organic Pollutants: POPs).

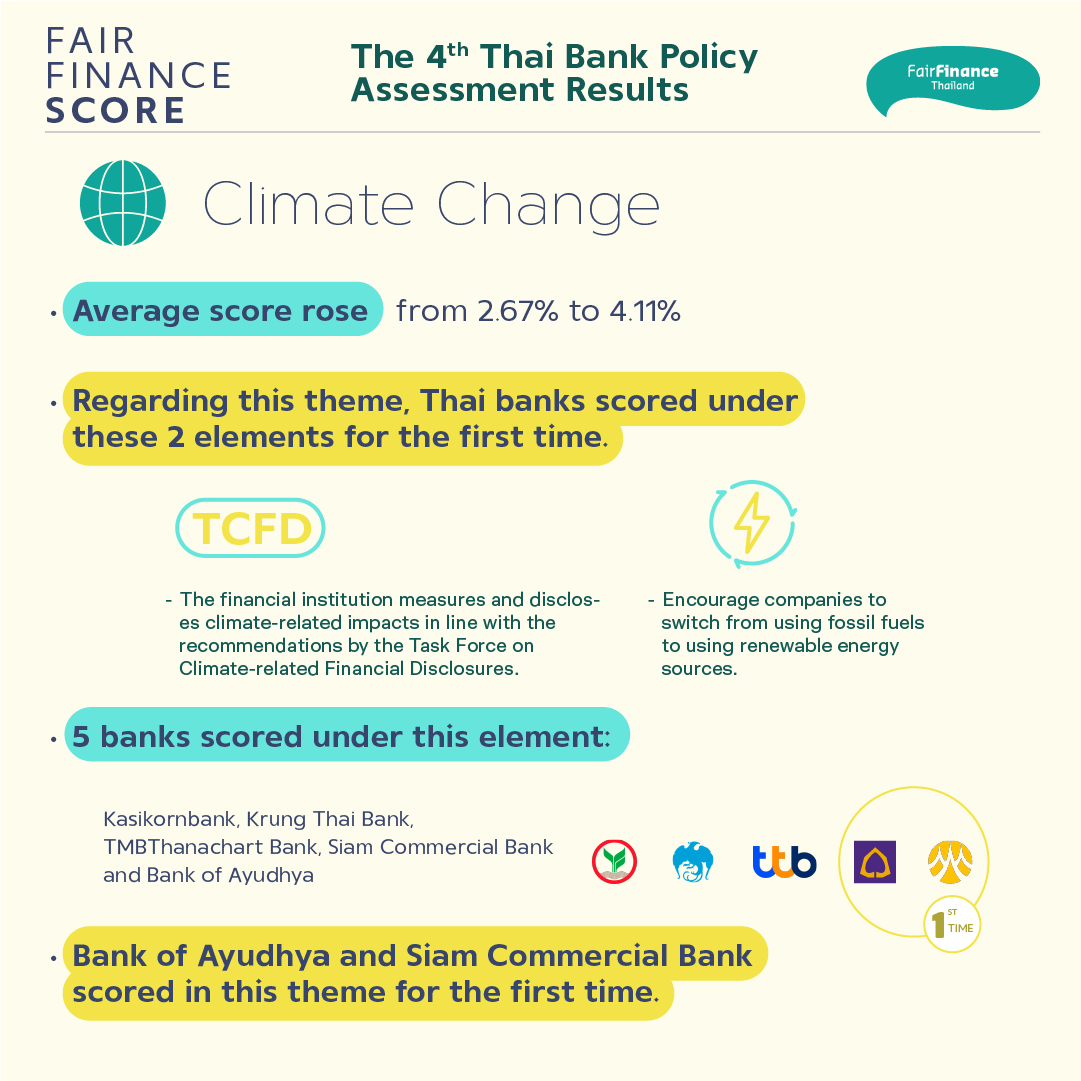

In ‘Climate Change’ theme, 5 scorers are Kasikornbank, Krung Thai Bank, TMBThanachart Bank, Siam Commercial Bank and Bank of Ayudhya. Siam Commercial Bank turned around this year while it did not receive any score in the previous year and Bank of Ayudhya accomplished a mark for the first time. Thai banks also receive a score in 2 criterias of measuring and disclosing climate-related impacts in line with the recommendations by the Task Force on Climate-related Financial Disclosures, and encouraging the companies to switch from using fossil fuels to using renewable energy sources for the first time.

In ‘Climate Change’ theme, 5 scorers are Kasikornbank, Krung Thai Bank, TMBThanachart Bank, Siam Commercial Bank and Bank of Ayudhya. Siam Commercial Bank turned around this year while it did not receive any score in the previous year and Bank of Ayudhya accomplished a mark for the first time. Thai banks also receive a score in 2 criterias of measuring and disclosing climate-related impacts in line with the recommendations by the Task Force on Climate-related Financial Disclosures, and encouraging the companies to switch from using fossil fuels to using renewable energy sources for the first time.

Gender equality gains more audiences from the banks

Gender equality in this 4th annual policy assessment showed interesting improvement in contrast to the relatively low result of Thai banks in the years before. Average score spiked from 3.3% to 10.3% with the top scorer namely Bangkok Bank, Siam Commercial Bank, Krung Thai Bank, Kasikornbank, Bank of Ayudhya, TMBThanachart Bank, TISCO Bank, Kiatnakin Phatra Bank, Government Savings Bank and Small and Medium Enterprise Development Bank of Thailand.

One of the awarded elements for Bangkok Bank, Siam Commercial Bank, Krung Thai Bank, Kasikornbank, TMBThanachart Bank are the establishment of salary and bonus pay equity policy and the disclosure of gender pay gap. Furthermore, Bangkok Bank, Krung Thai Bank, Kasikornbank and Kiatnakin Phatra Bank also received the score in announcing the policy committing to zero tolerance towards all forms of gender-based discrimination, as well as any verbal, physical and sexual harassment.

In addition, scores are granted to Siam Commercial Bank, Government Savings Bank and Small and Medium Enterprise Development Bank of Thailand for having or guaranteeing the

participation and equal access of women at Board of Directors, Executive positions, and Senior management level at no less than 40% of all employees.

Most financial institutions scored in the gender equality theme for the first year and demonstrated interesting score development as a result from the protection of all forms of harassment and the endorsement of gender equality in employment and occupation.

Financial inclusion and consumer protection, the new course for an easy and fair living

‘Financial inclusion’ and ‘consumer protection’ result oftenly ranked high in every year assessment. For the 4th annual policy assessment, most banks adopt even more specific policy addressing these themes reflecting in higher scoring results.

For consumer protection, many banks publish their policies, procedures and their representative company regarding the debts collection in greater depth. Disclosure includes the accountability of financial institutions in case of robbery, theft and fraud involving customers in bank branches, ATMs together with the internet and authorized agents’ malpractices.

Several banks also have various policy to provide accessibility for disable customer or those with special needs at all physical branches and online platforms. Bangkok Bank, Siam Commercial Bank, Krung Thai Bank and TMBThanachart Bank implemented a system allowing visual impairment customers to access their financial services.

Majority of Thai banks received a considerably high score in the ‘consumer protection’ at the peak of 8.57 out of 10. Meanwhile, no Thai banks scored lower than last year’s assessment.  As for ‘financial inclusion’, no bank gains a lower score than 20% of the total. Well-received digital banking and the financial services expansion to poor and SMEs (Small and Medium-sized Enterprises) groups contribute to the score improvement at 64.4% from 57.1%.

As for ‘financial inclusion’, no bank gains a lower score than 20% of the total. Well-received digital banking and the financial services expansion to poor and SMEs (Small and Medium-sized Enterprises) groups contribute to the score improvement at 64.4% from 57.1%.

Significant progress is where Krung Thai Bank, Kasikornbank, Bangkok Bank, TMBThanachart Bank and Government Savings Bank do not charge clients or only charge for a reasonable fee to open their basic bank account. Bangkok Bank, TMBThanachart Bank, Siam Commercial Bank, Kasikornbank, Bank of Ayudhya, Bank for Agriculture and Agricultural Cooperatives and Small and Medium Enterprise Development Bank of Thailand also publish clearer standard and provide publicly disclosed information on credit processing time. Siam Commercial Bank adopts a policy to disclose client’s rights and risks of product or service (including risk of over indebtedness) offered to low-literate clients and MSMEs (Micro Enterprise and SMEs).

Score trends in both ‘consumer protection’ and ‘financial inclusion’ themes reflect financial institutions’ responsibility through various protection standards while maintaining alert to the novel development of financial technology (Fintech), encouraging a more accessible and safe financial services for the consumers.

This 4th annual continuous endeavor of Thai banks policy assessment unfolds the thrive for improvement across all themes, especially the substantial scoring increase in social and environmental responsibility. It could be expected that the Thai financial institutions will remain persistent in developing their policies and practices towards fair finance standards, the new norm of sustainable finance.

For more information, view the Fair Finance Thailand’s 4th annual policy assessment scores at https://fairfinancethailand.org/